#2020 tax tables pdf driver

Examples are electricity, water, vehicle with driver and fuel, vehicle and fuel, vehicle only, fuel only, etc.Īccommodation and loan benefits are also benefits in kind which are quantified in the law. Benefits to the employees in kind are added for tax purposes, but when the benefit is paid in kind, it is quantified in monetary value before it is added. For 2020 and the years thereafter, you can normally complete an online M Form via Mijn Belastingdienst (.

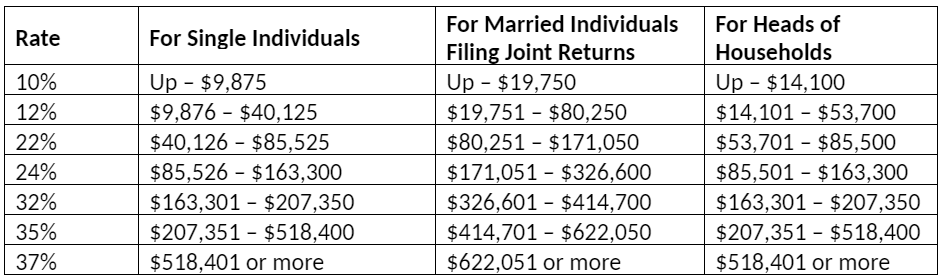

These are some of the allowances that will be added to salary for PAYE purposes:Īllowances paid in cash are added to the salary. Contributions and donations to a worthwhile cause.The Federal Budgets of 20-23 did not result in any changes to tax rates or income thresholds for the 2022-23 or 2023-24 income years. Provident fund up to 16.5% of your basic salary either paid by the employer or employee or both. ATO Tax Table Tax Tables The current tax tables in use came into force from 13 October 2020 and continue to apply through to the 2023-24 years (with limited exceptions noted below).The top marginal income tax rate of 37 percent will hit taxpayers with taxable income of 518,400 and higher for single filers and 622,050 and higher for married couples filing jointly. GSA has adjusted all POV mileage reimbursement rates effective January 1, 2023. In 2020, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (Table 1). Mortgage Interest paid on only one residential premise of the employee’s lifetime. Privately Owned Vehicle (POV) Mileage Reimbursement Rates. Personal Exemptions, Standard Deductions, Limitation on Itemized.Employer Withholding Tax Guide & Tax Tables (PDF). Florida Department of Revenue - The Florida Department of Revenue has three primary lines of business: (1) Administer tax law for 36 taxes and fees. TurboTax will apply these rates as you complete your tax return. Social Security and National Insurance Trust (SSNIT) – 5.5% of basic salary. The East Lansing income tax forms for employers, individuals, partnerships and corporations are below. OVERVIEW These tax rate schedules are provided to help you estimate your 2022 federal income tax. Ohios individual income tax brackets have been modified so that individuals with Ohio taxable.Total income is made up of six major income classifications: paid employment, pension income, investment income, self-employment income, social benefit payments, and other income.These items are deducted from an employee’s income before calculating PAYE: The Canada Revenue Agency determines the classification based on the largest source of income reported on the taxfiler’s individual income tax and benefit return.įor example, if a taxfiler earned a salary but reported more income from investments, this taxfiler was classified as an investor, not as an employee. Taxfilers do not report their type of work or occupation.

0 kommentar(er)

0 kommentar(er)